Latest Articles

How Bankruptcy Works – Types And Consequences

Bankruptcy is a legal process that eliminates all or some portion of the debt that you owe. However, this happens after some stern consequences. Knowing the entire process of filing bankruptcy for credit card debt can help you determine whether the perks are even worth the drawbacks or not. This also includes understanding the various […]

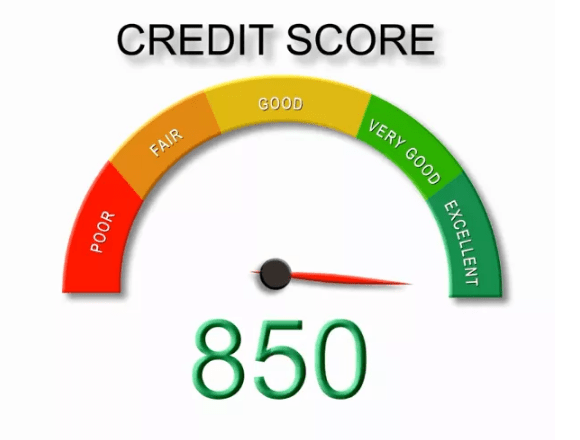

How Many Americans Have A Perfect 850 Credit Score?

As they say, “No one is perfect”. However, when it boils down to max credit score, a tiny portion of Americans actually are perfect. For many U.S. consumers, practicing to enhance credit score ranges is what makes their scores perfect. According to data Experian data, about 1.54 percent of consumers are proud of their Perfect […]

Why Did My Credit Score Drop?

You might feel frustrated or angry thinking about why did my credit score drop for no reason? while a few points down or up isn’t a big deal. However, a constant bad credit score is concerning. Your credit scores change all the time. This is because the data that is used to calculate your scores […]

How To Use A Credit Card To Build Credit

Have you ever thought about the advantages that you can avail through a credit card? The opportunity to earn rewards? The additional spending flexibility? Or the extra protection from security features? Or is it the ability to use credit cards to build credit? By using your card responsibly, it can be a great tool to […]

How To Get An Apartment With Bad Credit

Whether you have begun your first job in a new place with zero credit or you got into some credit card debt a while ago, low credit scores might occur. Sadly, having less-than-stellar credit might make it way more complex for you to get those shiny keys to an apartment if you reside in an […]

How To Unfreeze Your Credit Report

If you placed a security freeze (also known as credit breeze) to prevent people from accessing your credit reports, you might want to reopen your credit files sooner or later. For instance, you might need to open them to rent an apartment, apply for a new car loan, or get a credit card. To do […]