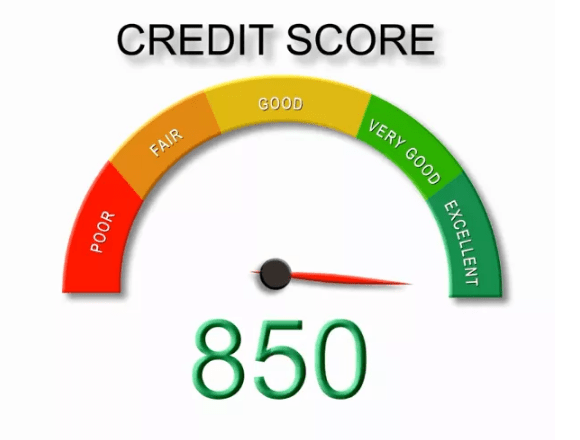

How Many Americans Have A Perfect 850 Credit Score?

As they say, “No one is perfect”. However, when it boils down to max credit score, a tiny portion of Americans actually are perfect. For many U.S. consumers, practicing to enhance credit score ranges is what makes their scores perfect. According to data Experian data, about 1.54 percent of consumers are proud of their Perfect FICO 850 credit score.

If you, too, wish to get the highest credit score you can get, then you have landed on the right spot. Below, we have spilled some tea regarding how many Americans have an ideal score and how you can also become one of them. So, let’s begin.

Traits Of Consumers With Perfect Credit Score Number

If you have an average credit score, you might keep making mental notes to improve it and then be careless about it. This is what happens, but remember! You can never improve your scores in this way. And, even if you hire trusted credit score monitoring services, they will have a hard time elevating your score because of your bad credit habits.

If you really want to get the highest credit score, you need to learn about the traits of consumers who have a perfect score. Without further ado, let us get straight to the traits that you need to adopt, too, if you are aiming for the credit score highest number.

Near-Zero Credit Utilization

On average, people with a top credit score tend to have more credit cards. And despite that, their credit utilization rate is much lower. So, it makes it pretty clear that credit utilization is one of the most significant factors in calculating credit scores. Consumers with a credit score of 850 are known to keep it in the low single-digit percentages.

Wise And Patient

Another thing that people with a credit score 850 do is rather than buying something that catches their attention, they have mastered the skill of patience. By sleeping on the idea of getting something and discussing it with a wiser friend, they can make sure that they do not end up wasting their money on unnecessary expenditures. This not only helps to minimize overall spending but also ensures that alternative options can be weighed prior to reaching a decision.

Organized Living

There are about 21.9 percentage of people with 800 credit score or above. This means that the rest of the population has a score that is lower than that. What makes this minority able to possess a credit score max is that they strictly follow a monthly budget. This budget assists them in planning and monitoring their spending for both short-term and long-term goals. So, no matter if it is a vacation budget, a wedding budget, or even a household budget, keeping your money organized can make a great difference.

Financial Efficiency

Anyone who gets the highest possible FICO score uses a wide, massive array of tools to make the most of their finances. For instance, you can use automation, or you can also opt for reputed credit score services to maximize your scores. Consumers with perfect scores are great users of financial automation. They use it to help create monthly saving deposits, pay recurring bills, and much more. By putting their $$$ on a constant timeline, they can make sure that all of their financial responsibilities are completed within time every month.

Timely Payments

Apart from their scheduled payments, consumers with an 850 credit score tend to pay their miscellaneous bills on time or early. This gives them room to be certain that their monthly debts are paid prior to making any extra transactions. To ensure that they have not missed any payment, such consumers also check their credit scores on a periodic basis. Typically, if there is a missed payment or there are a lot of inquiries in a short span of time, this can also raise a flag for credit report bureaus. Consequently, this causes them to lower their associated credit scores. This also prompts the individual to check an issue and resolve it prior to any further damage being done.

Frequently Asked Questions (FAQs)

-

How do you get the highest possible credit score?

If you are thinking of getting about an 830 credit score, then you need to know that you cannot do so by sitting idly. Instead, you need to follow a bunch of steps to ensure a shining score on your credit reports, i.e.:

- Maintain a better understanding of your credit score and report.

- Pay your bills on time.

- Keep a low credit utilization rate.

- Pay off your balances in full.

- Never apply for credit frequently.

-

What’s the highest credit score you can get?

For both the FICO and VantageScore models, the highest credit score is 850. However, even if you practice ideal credit habits, do not be disheartened if you find your score to be below 850. Many times, the answer to the question What is the highest credit score? is said to be 900. However, this is not true, as the credit scoring models have a max credit score limit of 850, and maintaining that score can be quite challenging.

-

What are 850 credit score benefits?

Some of the benefits one could avail by maintaining one’s credit scores include:

- Become eligible for almost all of the best credit cards.

- Gets some of the ideal interest rates on the market.

- A higher score also makes it easier to rent an apartment or a car.

- It might even help you secure your dream job, as many employers run a quick check on your credit history during the interview process.

Summing It All Up!

While the idea of having the highest FICO credit score is amazing, you need to know that it is not something that can happen in a night or two. In order to achieve this, you need to maintain great credit habits consistently, such as:

- Low revolving credit balances in contrast to credit utilization ratio (credit limits).

- Few, if any, delinquencies reported on credit accounts.

- A long credit history.

Even if some of these habits seem impossible at the moment, we suggest you start practicing them anyway. You will be shocked to see how they will soon yield results if you consistently follow them. Even if it does not help you secure a credit score over 850, it can nevertheless make it easier for you to borrow when you need to.