Whether you have begun your first job in a new place with zero credit or you got into some credit card debt a while ago, low credit scores might occur. Sadly, having less-than-stellar credit might make it way more complex for you to get those shiny keys to an apartment if you reside in an area where credit scores play a huge role in the rental equation.

Getting apartments no credit check is something extremely difficult. But, fortunately, it is not impossible. It might only take a little more work and that is it. If you are willing to know more on this matter, then let us start with.

Do You Need Credit To Rent An Apartment?

There are a few things that you need to be aware of regarding “Can you get an apartment with bad credit.” Firstly, while checking renting applications, landlords use credit to review the applicant’s ability to pay on time. This information is present in your credit report, along with your overall financial situation. Moreover, if you have a low credit score or bad credit, with a history of paying your bills after the deadline, then your prospective landlord might think of you as someone who does not pay rent on time.

And why would any landlord want to end up with a non-paying tenant? It would only make them go through an expensive and lengthy legal process to remove the tenants. Thus, it is needless to say that the preference is to get it right on the very first step, which is by doing a credit check. If you have a bad credit score, then worry not. Because there are many strategies that you can follow to get yourself an apartment, let us look into it, shall we?

How To Get Approved For Apartment With Bad Credit?

Offer A Larger Deposit

Just because you have bad credit does not mean that you will be denied an apartment. There are still apartments that accept bad credit. However, for that, you must be prepared to pay a bit more (if you really need the place) upfront by a few month’s rent before time or an increased deposit to ease any of the concerns your landlord might be having.

Find A Cosigner Or Guarantor

A lot of areas that offer low credit 534 rent apartments require a cosigner if the applicant does not make it above a specific income based on the monthly rent charged. And, even if your apartment does not need it, getting someone to cosign with you might be the ultimate answer to your apartment issues. You must know that a cosigner has to sign a legal document that states that if the applicant misses a payment, they will be liable to make those payments in their place. So, you must have a trustworthy cosigner since their credit might be negatively affected by any mistakes that you make.

Show Proof Of Steady Income

Can you rent apartment with bad credit? If this question is bothering you, here is a tip to shoo away your worries. Showing up prepared is an ideal way to convince your landlords that you are indeed serious about your application, even if you do not possess the credit to back it up. It also proves that you are responsible in other areas, no matter if you have not been able to achieve a perfect credit score just yet. For instance, if you have a sufficient amount in an emergency fund to cover a bunch of months’ rent, make sure you bring such statements as a backup.

Provide References From Previous Landlords

Bring some up-to-date financial documents to prove your income for the past few months, particularly if you make a good salary. Moreover, you can also bring some letters of recommendation as well. Getting letters from your previous landlord confirming that you are indeed dependable and reliable might work wonders. So, if you were thinking, Can I get an apartment with no credit check? You totally can.

Sign A Lease With Someone Else

Another way how to get approved for an apartment for rent with bad credit is to sign a lease with someone else. However, this one requires a good amount of trust. If you are comfortable with getting an apartment with a roommate, you can have the application run in your potential roommate’s credit score; then, you can make your rent payments directly to them. This would not work in every situation, although some of the landlords need all occupants to be on the lease.

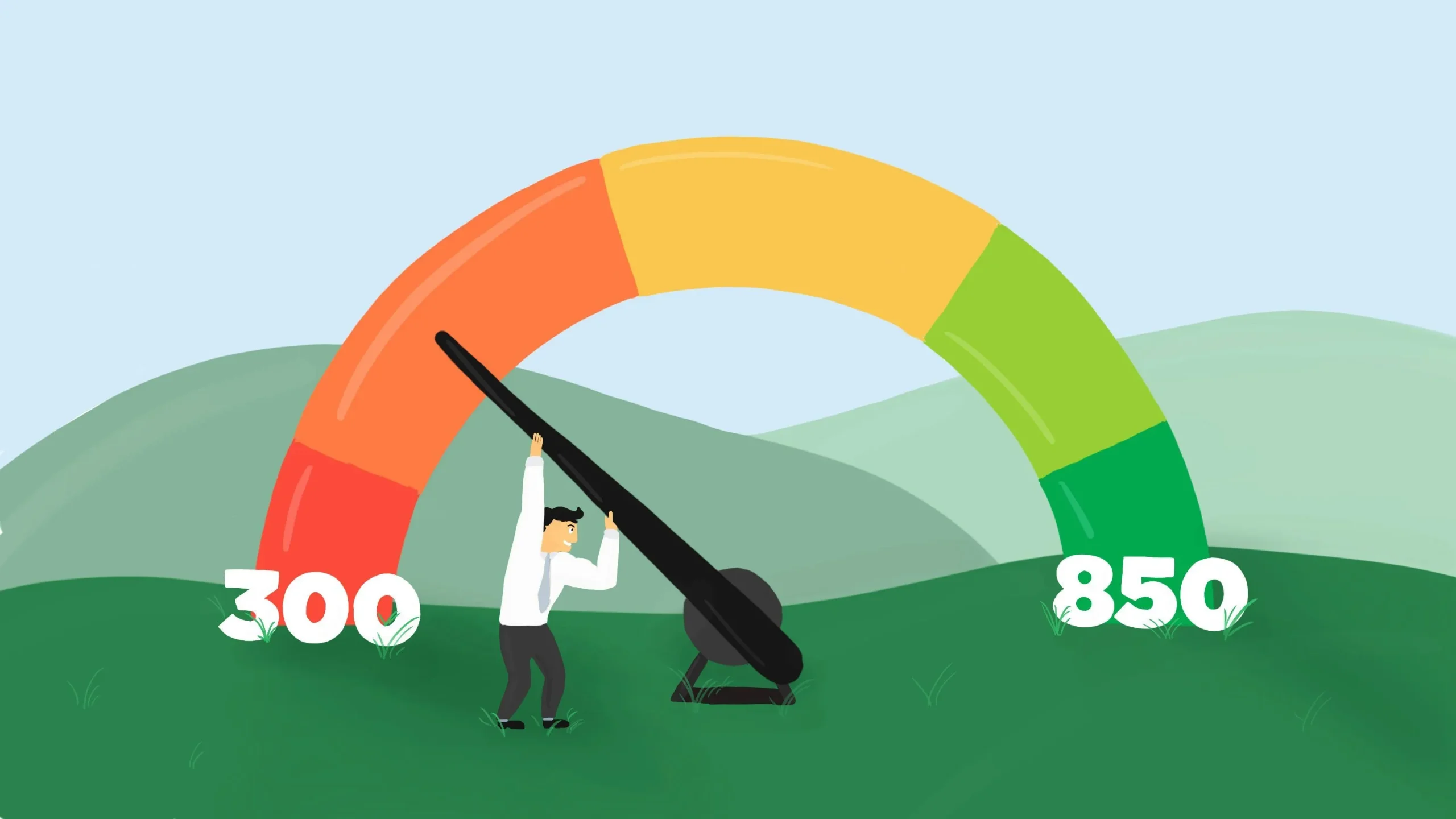

How To Increase Your Score To Get An Apartment?

Instead of securing an apartment at a higher price or compromising on your dream house, why not work on your score? Here are some tips that will help you raise your score up a notch.

Pay Bills On Time

Thirty-five percent of your entire credit score is your payment history. How you pay your bills and if you do it on time plays a massive part in your score. When a potential landlord reviews your credit report, they are basically looking to get an idea of your payment history. There is a strong correlation between your ability to pay your rent and your bills on time. In this case, you can try renting with bad credit but high income.

Reduce Debt

It is also significant to lessen your debt and the balances you have on your cards. Your credit usage also plays an important part in your credit score monitoring services. It is the percentage of available credit that is in use. The lower your rate, the more you will score. Lower credit usage also indicates that you are using your credit responsibly.

Dispute Credit Report Errors

When you are trying to get approval for apartments that accept bad credit, some of the elements on your credit report that can pose a threat to your plans might surprise you. It makes sense to collect all three major credit reports, check if there are any issues, and file a credit report dispute to get rid of them. If you need help with disputing these errors, you can contact experts from Gifted Financial Services, and they will efficiently handle these matters on your behalf.

Frequently Asked Questions (FAQs)

-

What is the minimum credit score to get an apartment?

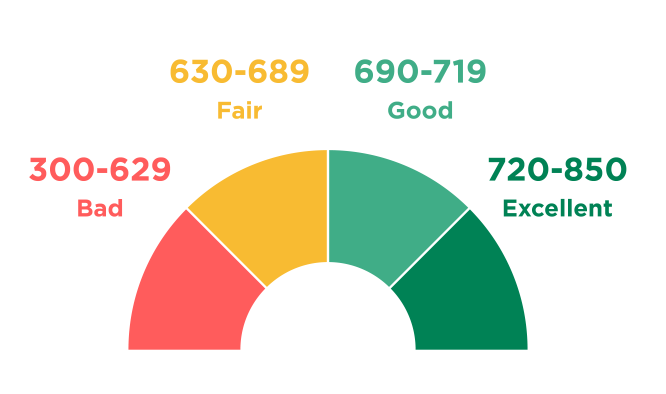

If you need an apartment with bad credit, you will be glad to know that there is no minimum credit score you need to rent an apartment. Generally, landlords prefer applicants with a great credit score (at least 670).

-

How to apply for an apartment with bad credit of 500?

Although the minimum credit score to get an apartment is at least 670, the good news is that you can get an apartment even if you have a credit score of 500. You might not be able to rent the apartment of your dreams till you improve your credit, but you find a good home to rent by shedding light on your other asset.

-

Which credit score do most landlords look at?

Usually, landlords look at TransUnion, Equifax, and Experian to check your credit score and report. Your landlord might prefer using one report over another (it can be any) as there is no industry standard for apartments.

Summing It All Up

And that is it! We hope this answers all your queries regarding “How can I get apartment with bad credit?” Even though getting bad credit apartments is possible, it is difficult. So, why tread in hot water when you can avoid the entire situation by maintaining or fixing a perfect credit score? We suggest you try fixing your score rather than finding loopholes. It will serve you a lot better in the long run. But, if you have no other option, then you can literally get yourself an apartment even with a poor credit score.