Credit score ranges can get a bit confusing. One of the primary reasons is that there are different types of credit scores. This is what makes it difficult, but not impossible, to determine what credit range you lie in. Understanding your credit status begins with knowing your credit score with the help of our best credit score monitoring service in the first place. You can also hire experts from Gifted Financial Services to elevate your credit scores.

If you are clueless about the different credit score ranges, then read on as we pull the curtain back for you to get an unblocked view of your credit score range. Here you go!

What Is A Credit Score?

A credit score is a three-digit number, mostly on a scale of 300 to 850. It estimates how likely you are to pay your bills and repay the money you borrowed. Bad credit scores are measured from the information regarding your credit accounts. The data is collected by credit-reporting agencies, also known as credit bureaus. They are compiled into your credit reports. The major credit bureaus are Experian, Equifax, and TransUnion.

You do not have a single credit score. You have a bunch of them. They probably vary slightly. This is because two major companies measure scores. The highest credit score that you can get is 850. Even though there is not much difference between a “good credit score” and an excellent credit score when, it boils down to the products and rates you can qualify for. In simpler terms, do not stress over trying to achieve an 850 score because these scores tend to fluctuate rapidly.

What Is The Difference Between FICO Score And VantageScore?

Two major companies dominate credit scoring: VantageScore and FICO Score. The latter is more popular. Generally, both of them use a score range that lies between 300 and 850. Both of these companies also have several different versions of their scoring formula. The scoring models used most often are VantageScore and FICO. Both of them pull from the same data, weighing the information somewhat differently. They tend to move in cycles. If you have a perfect VantageScore, your FICO is most likely to be high as well.

Also Read: What Is a Credit Privacy Number (CPN)?

Why Do I Have Different FICO And VantageScore Credit Scores?

Your credit score can vary every time you check it. It can vary depending on which credit bureau supplied the data used to generate the scores. Moreover, it also depends on when the bureau supplied the credit report data. Not every creditor gives account activity to all three bureaus, so your credit report from everyone will be unique.

FICO Score Ranges

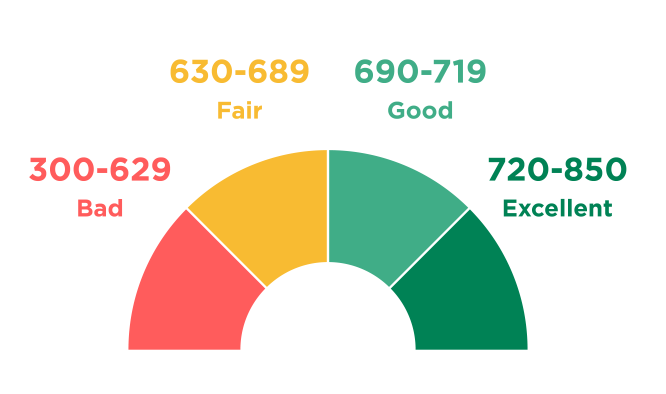

Here is how your credit scores are broken down in FICO:

- Below 580: Bad

- 580 to 669: Fair

- 670 to 739: Good

- 740 to 799: Very good

- 800 and above: Exceptional

VantageScore Ranges

As you know already, VantageScore has slightly different credit score tiers, which are:

- 300 to 600: Subprime

- 601 to 660: Near prime

- 661 to 780: Prime

- 781 to 850: Superprime

What Are The Credit Score Ranges?

Creditors have their own standards set for what scores they will accept. However, these are the general guidelines:

800 To 850: Excellent Credit Score

A lot of people have an 830 common credit score. People in this range are said to be low-risk borrowers. They can secure a loan way easier than the borrowers with lower credit scores.

740 To 799: Very Good Credit Score

People who lie in this range have displayed a history of good credit behavior. Consequently, they might also have an easier time getting approved for additional credit.

670 To 739: Good Credit Score

Lenders often see people who have a score of 670 or more as lower-risk or acceptable borrowers. So, if you have a 728 credit score, try your best to maintain it.

580 To 669: Fair Credit Score

People who fall into this category are usually considered “subprime” borrowers. Lenders consider them as high-risk borrowers. Due to this reason, they might have trouble qualifying for new credits.

300 To 579: Bad Credit Score

People in this range usually find it hard to get approved for new credit. If you find yourself in this category, then you might have to take a bunch of steps to increase your credit scores to at least 657 credit score. Only then you will be able to secure any new credit.

What Factors Impact Your Credit Scores?

Both the main credit score models that we discussed above consider more or less the same factors but weigh them a bit differently. For both of them, two factors matter the most.

Payment History

A slip-up in making timely payments can go a long way. A late payment that is 30 days or more past the due date remains on your credit history for many years.

Credit Utilization

This term defines how much of your credit limits you are utilizing. It is ideal to use less than 30 percent of your credit limits; the lower, the better. You can use a lot of effective strategies to lower your credit utilization.

Apart from these factors, there are several factors that do not weigh as much, but they are still worth considering.

Credit History

The longer you have had credit and the higher the average age of your accounts, the better your score will be.

Credit Mix

Score rewards have various types of credit, such as a credit card or even a traditional loan.

How Recently You Have Applied For Credit

Whenever you apply for credit, a rigid inquiry on your credit report might end up in a temporary dip in your overall score.

Factors That Don’t Affect Your Credit Scores

There are a lot of things that are not mentioned in credit score calculations. These elements usually have to do with demographic characteristics. So, if your credit score is below 605 credit score, it might not have anything to do with these factors. These factors include:

- Your ethnicity

- Race

- Marital status

- Gender

- Age

- Employment history (such as your title, salary, where you live, or your employer)

Frequently Asked Questions (FAQs)

Can you have a 900 credit score?

The previous models of credit scores used to go up as high as 900. However, you can no longer get a 900 credit score. The highest score you can get today is 850. Anything above 800 is thought to be a perfect credit score.

Is 641 a good credit score?

If you have a 641 credit score, you are going to be considered a subprime consumer, but it would not necessarily prevent you from borrowing money.

Is 683 credit good?

A FICO Score of 683 credit score falls between 670 to 739, that are thought to be categorized as good. The average U.S. FICO Score falls within this range.

How good is 651 as a credit score?

A 651 credit score is thought to be a fair credit score. If you have this score, then you will have many borrowing options, but the terms might not be very fascinating. For instance, you can get a small amount with certain personal loans or unsecured credit cards. However, the interest rate would be high.

Summing It All Up!

And that is it! We hope that by reading the information provided above, you are all aware of credit score ranges. We understand that it might be difficult for you to keep track of the different credit card bureaus. How about we give you a shortcut to monitoring your scores? Sign up at Gifted Financial Services right now, and you will have all your credit scores from major bureaus in one place. It will help you stay on track and maintain your credit scores.