Do you need to cover unexpected medical bills, replace your home furnace because it is not providing enough heat, or consolidate your credit card debt? Personal loans are available to borrowers throughout the credit spectrum. However, with the right steps, you can make sure that you get the best loan that fits your budget and needs.

You can apply for a personal loan through online lenders, credit unions, or banks. If you qualify for a loan, you will get a lump sum of cash that you can spend on whatever you like. After that, you can pay your loans back in periodic monthly payments. If you are thinking of how you can qualify for it, then here are seven steps that will guide you through the loan application process.

Expert Steps On How To Get Approved For A Personal Loan

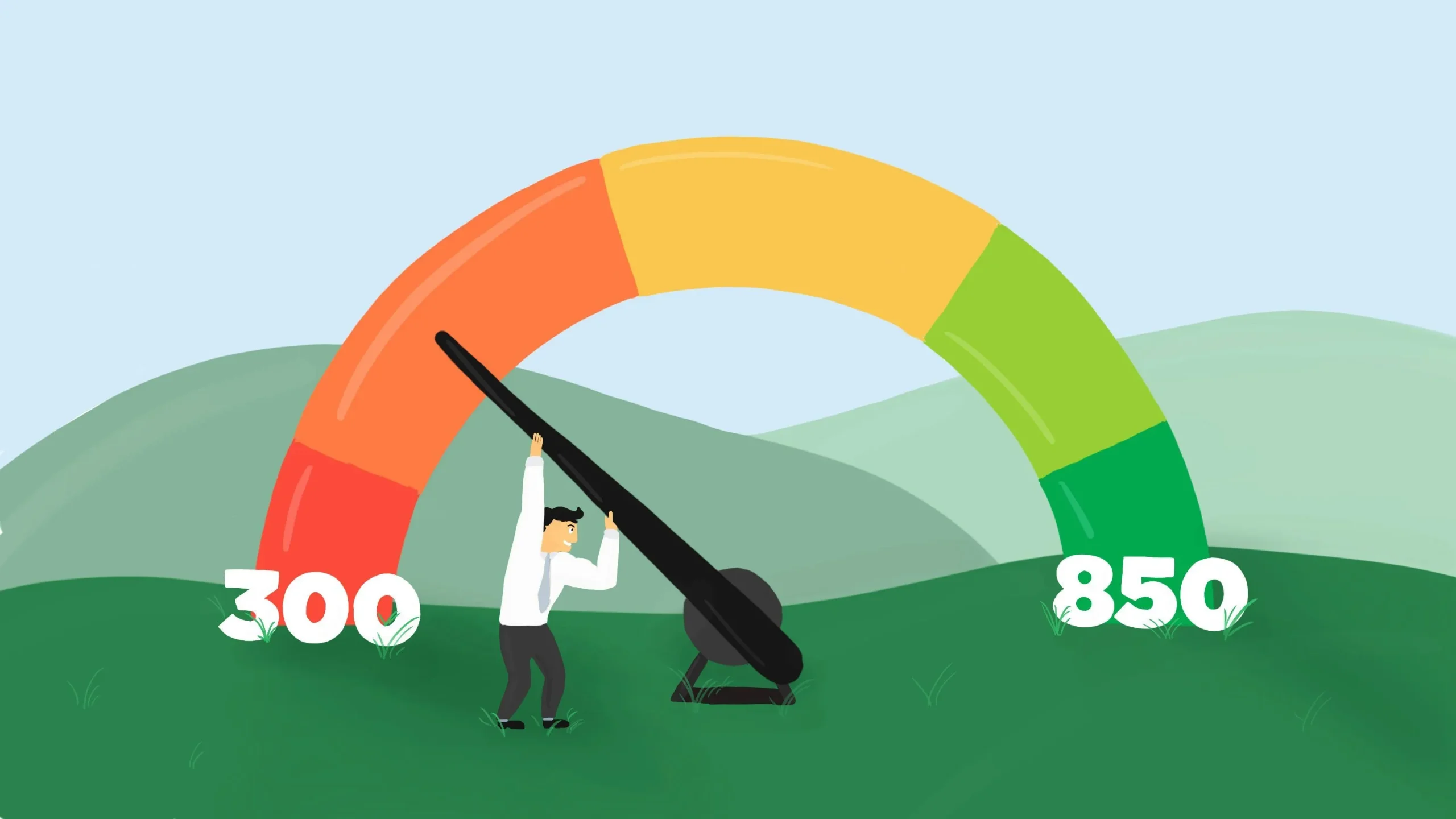

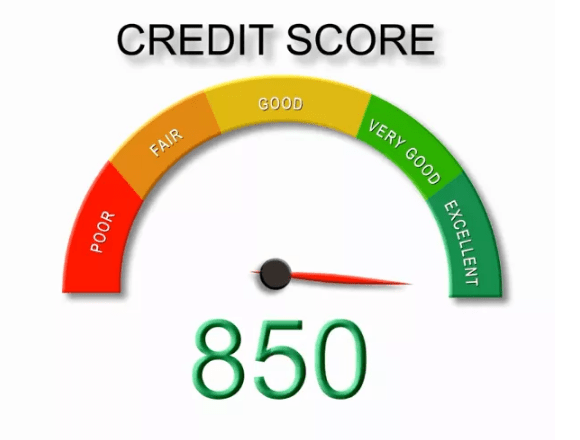

Step No. 1 – Check Your Credit Score

It is convenient to get better terms and a lower interest rate if you have perfect credit score ranges. So, the initial step for applying for a personal loan is to know your score. If it requires improvement, you must take all the effective steps right away to increase it. Moreover, you can also use this information to estimate rates or prequalify.

Step No. 2 – Compare Estimated Rates

After knowing your credit score, you must also build a clear understanding of the loan you need and how long you wish to have the loan (for term). Begin conducting your research on various lenders. You should compare estimated rates on the basis of your loan amount and credit scores. You can also use a personal loan calculator to compare your estimations. If your estimated rates are high, you can even consider a secured personal loan or even a co-signer.

Step No. 3 – Get Prequalified For Loan

To aid you in comparing more personalized terms and rates, you can prequalify for the loan if your lender permits it. It will give you a chance to preview your estimated rates prior to applying. This will prompt a soft credit check. So, if you have any concerns regarding “My credit score dropping,” then worry not, as it might not influence your scores at all. It will not automatically help you obtain a personal loan, and your actual rate might differ, but it will give you a great idea for comparison.

Step No. 4 – Conduct Your Research And Compare Lenders

Conduct your research with various lenders, as each one of them will offer you a different rate, fee, terms, reviews, customer service ratings, and types of loans. Think about what you require the loan for (i.e., for a wedding, medical bills, debt consolidation, etc.). Then, find a lender that offers everything that will help you get approved for a loan. To find the best rates, we suggest it would be best if you prequalify for loans with different lenders, such as credit unions, banks, and online lenders.

Step No. 5 – Read The Fine Print

Once you have cut down your options, ensure that you read the terms carefully and get answers to any queries that you might have. To be specific, focus on:

- Prepayment penalties, origination fees, and late fees

- You do not want any surprises once you apply for the loan

- Automatic withdrawal payment options

- Restrictions on what you can use the loan for

- Total APR (which includes fees), not only interest rates

- Customer-friendly loan features, i.e., reporting payments to the credit bureaus, how using the loan for consolidation works, or changing payment dates

Step No. 6 – Apply For A Loan Online

After choosing your potential lender, it is high time for you to apply for a loan. Many lenders will permit you to do this online. However, some of them request or require you to visit their branch and apply for it physically in person. Even though the application requirements might vary, typically, you will need:

- Identification, like a passport, driver’s license, Social Security card, or state ID

- Proof of income, like a bank statement, W2, tax return, or pay stub

- Proof of address, such as lease agreement or utility bills

Step No. 7 – Get Approved And Accept The Loan

If you get the approval, the lender will notify you, and you will need to accept the terms and finalize your loan documents. After doing so, the loan funds will be transferred into your bank account. If not, then you will be sent a check in about one to two business days. However, it might also take up to a week.

What Are The Benefits Of Applying For A Loan?

There are a lot of perks that you can get by getting a personal loan. However, these perks are dependent on several factors, in part on how you are planning to use the funds. The major benefits of getting loan approval are:

- Easy application process

- Lump sum funding

- No collateral required

- Fast funding

- Flexible repayment terms

- Improve your credit score

- Higher borrowing limit than credit card

- Predictable repayment schedule

- Lower interest rates than a credit card

Frequently Asked Questions (FAQs)

How can I get a loan?

There are seven steps to help you get a loan, i.e.,

- Check your credit score

- Calculate the amount you need to borrow

- Calculate an approximate monthly payment

- Get prequalified with multiple lenders

- Compare all loan terms

- Choose a lender and apply

- Review the offer and accept the loan

Can you get a personal loan in cash?

Personal loans are a type of installment credit. Unlike credit cards, they require a one-time cash payment. The borrowers then pay back the actual amount along with the interest in regular, monthly installments over the lifetime of the loan.

How long does it take to get a personal loan?

You might get a personal loan in as little as a business day after you apply. However, not every lender follows a streamlined process. So, you can also expect to get your funds in two to five business days or more.

Summing It All Up!

With this step-by-step process to assist you in assessing your lender options and finances, you now know how you can get a personal loan. If you are still confused, feel free to seek help from trustworthy credit score services, such as Gifted Financial Services.

Whether you apply now or in the future, you can now identify your loan requirements and get through the application process with no stress. Keep in mind that if a lender does not approve your application, then they might be doing you a huge favor. Getting your application declined can be a sign that you need to recheck your current credit obligations and improve your finances. By doing so, you can become the sort of borrower every lender wishes to see.